Insights into a study on the future of powersport shopping.

Jason Nierman is the co-founder and chief revenue officer of Rollick. Rollick connects manufacturers, dealers, finance and insurance providers with in-market consumers in the powersports, RV and marine industries to deliver a seamless customer journey. Rollick’s solutions, utilized by over 130 OEMs and thousands of dealers, include new customer acquisition, enterprise lead management, digital retailing, inventory marketing, customer experience/loyalty and marketing automation. For more information, visit Rollick.io.

In late summer/early fall of 2023, Rollick conducted a “Future of Buying” study to understand consumer shopping behaviors in the outdoor recreation space, receiving feedback from nearly 27,000 participants.

The study, which had an impressive response rate of up to 30% in some cases, was enabled through collaboration with 27 Rollick clients across the powersports, RV and marine industries. The findings aim to communicate how consumers interact with brands and dealers and the technologies utilized during their shopping experience.

Responder Demographics

The consensus in recreational product industry studies suggests a similarity among owners. However, a deeper analysis reveals distinct demographic differences across the different sectors and brands, particularly in age, with younger individuals favoring powersports and marine and older demographics preferring RVs.

The study also shows a gender skew, with powersports having predominantly male ownership (91%), highlighting the importance of understanding buyer needs and preferences. Additionally, there is a notable increase in wealth among powersports owners, indicating a shift towards a more affluent customer base. This urges brands to adapt their marketing to changing demographics and consumption patterns.

Most Frequently Used Online Sources

The study aimed to identify the tools and resources most utilized during powersports products’ shopping and buying process. Manufacturer or specific websites were the most visited (64%), surpassing dealer websites (58.6%). Additionally, independent platforms like rating and review sites, community social media pages and third-party industry websites also saw significant use, indicating consumers’ preference for third-party insights before making substantial purchases. The data suggests a consumer preference for a mix of direct brand information and independent third-party evaluations.

Expected Communication Frequency

Two key consumer trends emerged regarding communication in the shopping process. First, we found that powersports shoppers expect immediate responses from dealers via email and text upon inquiring about a product, with phone calls being less expected but still appreciated.

Second, due to the lengthy purchase cycles, consumers anticipate ongoing communication from either the dealer or manufacturer, especially if changes are needed in the product or delays in the purchase decision. They desire consistent updates over an extended period, highlighting the importance of prompt and sustained engagement to convey value to the customer.

Purchase Time Frames

The length of the purchase cycle significantly influences communication frequency and expectations. Powersports purchases typically conclude within a month or less, whereas other sectors take much longer — in many cases, four months or longer. Due to product price, variety and complexity, this extended cycle underscores the importance of a long-term nurturing strategy instead of focusing solely on immediate buyers.

Use of Technologies in Buying Processes

The study found that email is the most effective communication technology, according to consumers. Due to its non-intrusive nature compared to phone calls, it should be timely, personalized, immediate and short-term.

Augmented or virtual reality ranks second most effective. While artificial intelligence’s (AI) effectiveness was rated lower than these technologies, it is on par with automated texting and is expected to grow as it becomes more utilized.

Importance of Financial Factors

Financial factors are crucial in the decision-making process for consumers buying outdoor recreation products. By a slight margin, shoppers prefer fairness and transparency over securing low-interest rates or financing options. They also desire fair trade-in values and the ability to negotiate prices before visiting the dealership.

Furthermore, while in-house financing is commonly offered, consumers appreciate not feeling pressured to use it, emphasizing the importance of control and pre-decision transparency in the financing aspect of their purchase journeys.

Online vs. In-dealership Shopping Preferences

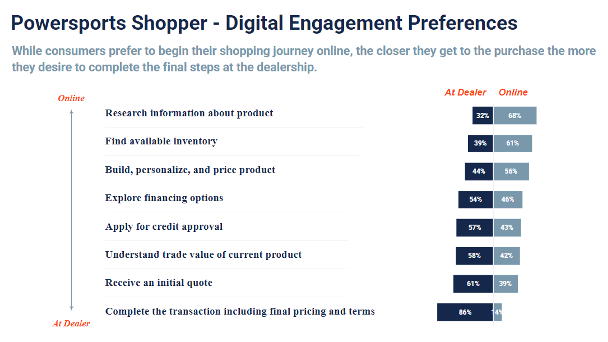

The trend of using technology for pre-purchase research is increasing, with consumers preferring to conduct most of their initial shopping and information-gathering online.

This tendency is more pronounced among younger buyers accustomed to online interactions and seeking a shopping experience that offers control, choice and access to a wide range of opinions and options, notably through online communities. However, despite the preference for online research, consumers still visit dealerships for final purchasing and delivery, arriving well-informed and prepared with the necessary financial details.

Reasons for Not Purchasing and Repeat Purchases

Rollick’s study also investigated why customers do not finalize purchases after dealer interactions. It identified inventory issues as the main deterrent (25%), followed by pricing (29%) and long wait times (12%). It outlined controllable factors related to communication and customer engagement that can impact purchasing decisions, emphasizing the role of online interactions.

Further, the study also acknowledged uncontrollable external factors, such as economic conditions, which can also influence consumer behavior. Understanding controllable and uncontrollable factors is crucial for brands and dealers to address customer pain points, potentially influence production strategies, and enhance customer retention through targeted solutions and engagement strategies.

What Is in a Consumer’s Garage and Dock?

Manufacturers are keen to dominate a consumer’s outdoor recreation space, and the study shows promising results: On average, owners in the powersports, RV and marine categories possess at least two additional products besides their primary ones. While chiefly focused on their category, powersports owners frequently own a fishing boat, indicating a blend of land and water interests.

Frequency of Product Usage

The study revealed that while numerous products are available for outdoor activities, powersports vehicles are used the most, with 50% of owners utilizing them for over 90 days due to their versatility in different weather conditions.

In contrast, marine products have the most minor usage, with only 18% of boat owners using them for more than 90 days. RVs are used between 30 and 90 days by 48% of their owners, aligning with seasonal travel trends. This usage data is crucial for dealers and brands to understand when and how consumers use their products, highlighting customer’s openness to owning various outdoor items, as evidenced by the “What’s in My Garage” findings.

Deep Dive Into the Rental Market Phenomena and the Impact on Converting Renters to Purchasers

The data revealed that while most powersports shoppers have not used rental services, those who have reported a significant increase in their likelihood of purchasing a product afterward. This suggests that rental services could be instrumental in converting renters into owners across industries.

Moreover, most current owners prefer to leave their products out of rental pools, posing a challenge for manufacturers who may need to supply these services directly, potentially creating new revenue streams but impacting dealers negatively.

Conclusion

Rollick’s “Future of Buying” study outlines a strategic guide for adapting to changing consumer behaviors in the outdoor recreation sectors, highlighting a shift towards a younger, wealthier and more diverse customer base.

It emphasizes the critical role of trust in online interactions and the necessity for transparent, responsive communication to accommodate long purchase cycles. The study suggests success lies in providing personalized communication, smooth financing options, and integrating online and physical dealership experiences.