By Chris Yeloushan, VP of Dealer Development, and Industry Relations

In late summer/early fall of 2023, Rollick, a national leader in marketing, technology, and market research in the outdoor recreation industries, conducted the Future of Buying study (FOB), which examines how recreational consumers engaged with their brand and dealers in their most recent shopping and buying experience and, more importantly, the tools, technologies and resources they relied upon.

A Collaboration of Insights

Twenty-seven leading brands across the marine, powersports and RV sectors joined with Rollick in this study, allowing access to their owners and prospects through the Rollick Aimbase database management system. The study, branded by the clients themselves, achieved an impressive response rate, with nearly 18 percent of participants engaging — an achievement notable in electronic surveys.

Understanding the Audience

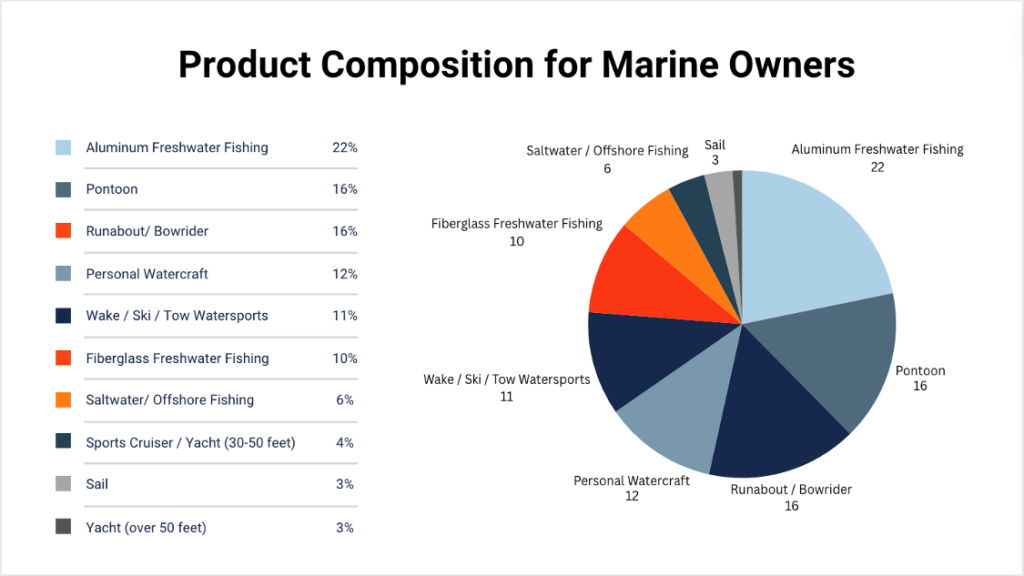

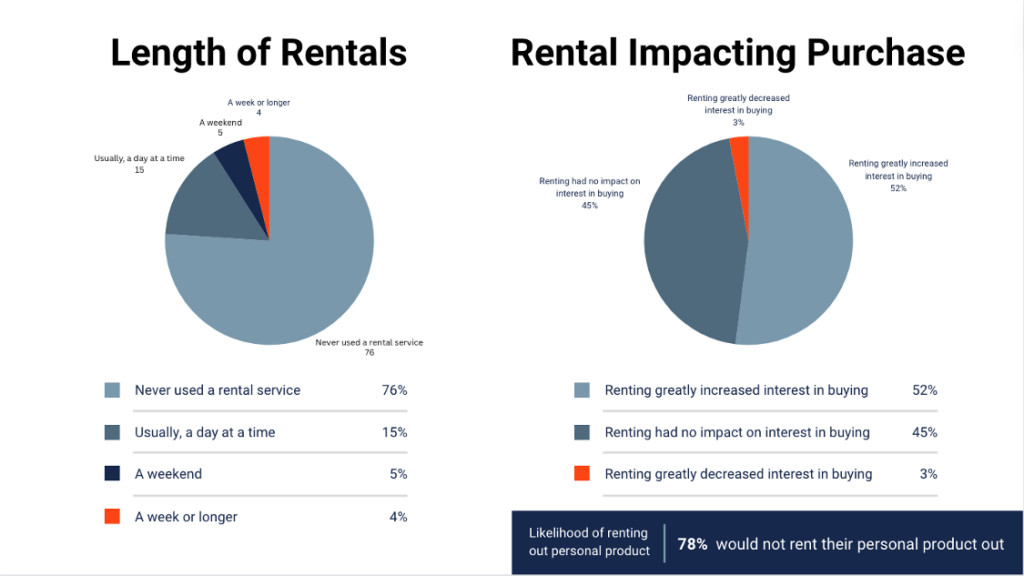

The study’s findings reveal a diverse audience comprising product owners and prospects. While most respondents were proud owners of their recreational products, a significant portion represented a crucial demographic—" new to the market” or first-time owners. Prospects, especially prominent in the marine sector, provided invaluable insights, including those who had opted to rent products before considering ownership—an exciting trend for exploration.

Response Time

Marine response time is becoming crucial as consumer expectations evolve. There’s a growing demand for prompt communication, with consumers expecting a phone call within 10 minutes of inquiry. This expectation reflects a broader trend identified in the study, where consumers prioritize immediate responses via email and text, especially from dealers, over traditional methods like phone calls. As the purchase cycle for Marine products typically spans over 4+ months on average, maintaining ongoing communication with consumers for a minimum of 1 year is vital to demonstrate value and sustain interest throughout the process.

This shift in consumer behavior highlights the importance of adapting communication strategies to align with evolving preferences.

Demographic Nuances

Diving into responder demographics unearthed interesting differences between industries and brands. Notably, marine and powersports owners skewed younger, with RV owners leaning towards an older demographic. The study highlighted a growing female ownership trend, underscoring the importance of catering to diverse consumer needs and preferences.

Online Engagement

In an increasingly digital landscape, online sources emerged as dependable in the consumer’s purchasing journey. Manufacturer websites proved to be the primary touchpoint for consumers across all industries, offering a wealth of information and guidance. While dealer websites played a crucial role, third-party and community-driven platforms garnered significant trust, signaling a shift towards consumer reliance on authentic, peer-driven insights.

Embracing Technology

The study showcased consumers’ appeal for innovative technologies, with email and augmented/virtual reality experiences effectively leading the pack. Email is the most effective communication technology according to the consumers. Due to its non-intrusive nature compared to phone calls, it should be timely, personalized, immediate and short-term.

As consumers gravitate towards immersive digital experiences, brands must harness the power of emerging technologies to deliver personalized, engaging interactions.

Navigating Purchase Dynamics

Understanding the intricacies of the purchase cycle is paramount, especially in industries like Marine, where buying decisions are often protracted. Consumers crave transparency and fairness in financial transactions, emphasizing the importance of clear communication and flexible financing options. Due to product price, variety and complexity, Marine’s extended cycle emphasizes the importance of a long-term nurturing strategy instead of focusing solely on immediate buyers.

The Rental Phenomenon

A fascinating revelation emerged regarding the rental market’s impact on purchasing decisions. While rental experiences often serve as a precursor to ownership, the Marine sector faces a unique challenge. A higher percentage of marine enthusiasts opt for rentals over ownership, raising questions about the industry’s future trajectory and the role of rental services in shaping consumer behavior.

Charting a Course Forward

As outdoor recreation continues to evolve alongside shifting consumer preferences and technological advancements, Rollick’s FOB study provides essential insights to shape industry standards. From leveraging digital transformation to fostering trust and transparency, success depends on adapting to consumer behavior. This study offers a new perspective on the outdoor recreation industry and highlights how customers expect to communicate in post-Covid times. With these insights, OEMs and dealers can confidently navigate this landscape to ensure sustained growth and success.

About the Author: Chris Yeloushan is our avid in-house expert in all outdoor recreation products. Chris is focused on building and developing key strategic programs within our OEM, Dealer, and Partner networks to help create the most efficient consumer buying and ownership experience. You can catch Chris any given day camping in the RV, on the ATV, or in the boat.

About Rollick: Rollick connects manufacturers, dealers, finance, and insurance providers with in-market consumers in the Powersports, RV, and Marine industries to deliver a seamless customer journey. Rollick’s solutions, utilized by over 130 OEMs and thousands of dealers, include new customer acquisition, enterprise lead management, digital retailing, inventory marketing, customer experience/loyalty, and marketing automation. In addition, the company has rapidly built its GoRollick.com outdoor recreational vehicle buying marketplace to include a nationwide network of dealers and an affinity partner network with access to over 250 million high-quality customers, including policyholders of major insurance providers, employees at more than 2,000 top U.S. companies, members of the military, veterans and first responders. For more information, visit Rollick.io.